Table of Contents

Among the popular terms in crypto like FOMO, HODL, there is one that sends shivers down the spines of coin holders when it is mentioned alongside their token:” FUD.”

Slang can throw the whole crypto ecosystem into disarray and lead to wrong decisions. FUD events can be a huge bluff or a loss depending on how well you read the signs.

In this article, we’ll cover everything you need to know about FUD in crypto.

FUD – An Acronym Which Stands For?

FUD stands for Fear, Uncertainty, and Doubt. It is a tactic employed by individuals (fudders) to sway the cryptocurrency market in favor of their actions. This is achieved by disseminating untrue, negative, and misleading information.

The goal is to raise skepticism around a particular digital currency as more people begin to doubt the integrity of their token; this usually results in a fall in the value of cryptocurrency.

Think of it this way: if all your friends drop a course in school because rumors are that the course’s lecturer fails students, wouldn’t you be inclined to drop that course too?

Examples of FUD

We’ve talked about how FUD can wreak havoc in the crypto market. But what does it look like? Let’s look at some real-world examples of FUD tactics:

Bitfinex Tether controversy

In 2018, rumors spread that a major crypto exchange (Bitfinex) and its connected digital currency (Tether) might not have enough real money to back up their value. This spooked investors and caused a temporary drop in crypto prices.

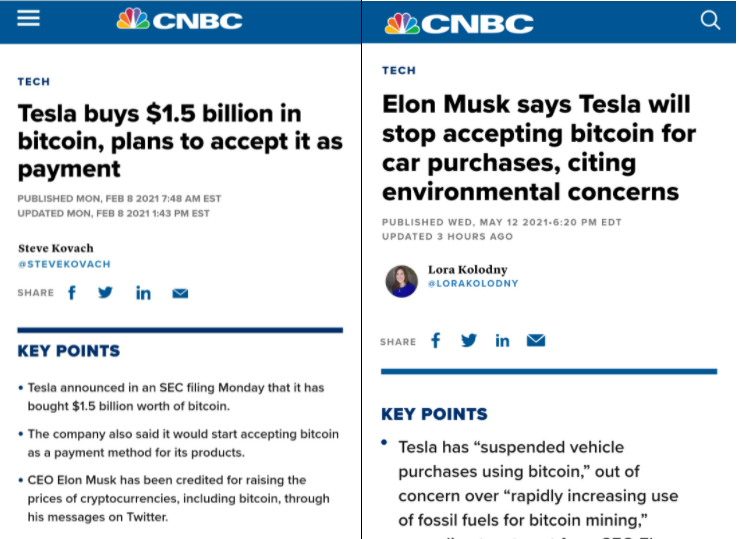

Elon Musk’s Bitcoin Announcement

Another instance would be the announcement Elon Musk made in May 2021. The Tesla CEO said that his company would not accept Bitcoin when users wished to purchase their electric vehicles because Bitcoin was a huge contributor to carbon emissions due to their use of fossil fuels. This news alone caused Bitcoin to fall around 10% in value.

China’s Crypto Crackdown

China clamped down on crypto in 2017. They banned trading platforms for cryptocurrencies and shut down new coin offerings. This caused a big drop in crypto prices because investors got worried, and some panicked, which caused them to offload their assets quickly, thus reducing cryptocurrency value in the market.

FUD vs FOMO: What’s the Difference?

At this point, you probably have a firm understanding of FUD, but there is another term on the other end of the spectrum called FOMO, which can sometimes be confused with the former.

While FUD is negative information spread to create fear, FOMO, also known as the Fear of Missing Out, is the anxiety of missing out on a potential opportunity to invest in a project.

This is often fueled by social media and the desire to keep up with the crowd. FUD is usually spread by people with a vested interest in manipulating the market, while FOMO can arise from social media hype or a lack of personal investment strategy.

FUD preys on fear and uncertainty, while FOMO is driven by anxiety and the desire to be part of something bigger.

How to Monitor, Identify, and Avoid FUD in the Crypto Market

Now you’ve understood the concept of FUD, it is important to know how you can spot and avoid FUD to make wise choices in the market. These are the ways you can identify and monitor FUD:

- Be Skeptical: Don’t believe everything you read online, especially about dramatic price drops or negative news. Always double-check information from trusted sources before getting spooked.

- Look for the Source: Who’s spreading the FUD? Are they reputable sources or random accounts? Be wary of unknown accounts or those with a history of negativity. Source out reliable platforms and find their take on the information in circulation. Look for supporting information or proof to verify the assertions.

- Check for Evidence: Does the FUD have any proof to back it up? If it’s just rumors or speculation, take it with a grain of salt. Compare and contrast the rumor using many sources to get a consensus of what verifiable sources have to say about a project.

- Do Your Research: Don’t depend solely on others’ opinions. Research the crypto project yourself to understand its fundamentals.

- Focus on Long-Term Goals: Don’t let short-term fluctuations faze you. Remember, you’re likely in crypto for the long haul, so stay focused on your investment goals.

- Stay Informed: Keep yourself updated on crypto news and trends, but avoid getting overwhelmed by negativity.

- Take a Break: If the crypto market becomes too noisy, step away for a while. Come back with a clear head and avoid making rash decisions.

By following these tips, you can confidently navigate the crypto market’s FUD storms. Remember, knowledge is your key to success in cryptocurrency, and a healthy dose of skepticism can be your best weapon against FUD.