Table of Contents

If you recently ventured into cryptocurrency trading, there are various concepts and terms that you’ll encounter.

One of them is Price Down Limit (PDL). It might sound complicated, and you might not be sure what it means now but don’t worry. Let’s break it down together.

What is Price Down Limit?

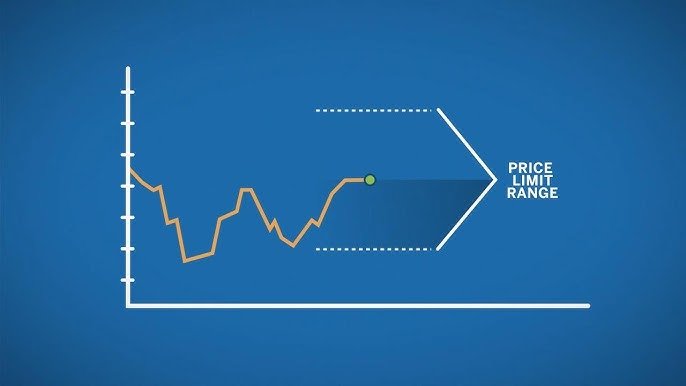

Getting right into it, Price Down Limit is a protective mechanism employed by cryptocurrency platforms, especially exchanges. Price Down Limit has a lot in common with Margin Call Level. Most cryptocurrency exchanges even use them interchangeably. With consent from you, the exchange sets a line at the lowest price that a certain collateral token can trade to before getting sold off.

This mechanism is there to protect you from fast and volatile changes in price, which can cause a total loss of your equity. What this simply means is any cryptocurrency you trade in can automatically get sold off if it declines below a specific level.

How Does the Price Down Limit Work?

The concept behind Price Down Limits is very straightforward. Simply put, when the price of a cryptocurrency approaches or falls below a limit that has been predefined, the trading platform will pause your trading activity and sell off your tokens.

This process is usually executed using automated trading halts built into the exchange. Let’s say you invested in a token with a Price Down Limit of 15%. If the asset’s value were to fall by over 15%, trading stops, and the token is sold.

Importance of Price Down Limit

Some of the main importance of Price Down Limits in the market are:

Preventing Panic Trading

When sharp falls in the price of your holdings occur, instead of trying to revenge trade and pile sell orders upon sell orders, which can increase the decline of your resources, Price Down Limits gives you a chance to pause and re-evaluate the situation.

Protecting Investors

With price down limits put in place, you can protect yourself from experiencing catastrophic losses from volatility. This will help protect your capital and increase your ability to survive in the market longer.

So basically, Price Down Limit plays a massive role because it maintains stability in the market and protects you from huge losses. Understanding Price Down Limit as a newbie in the cryptocurrency market is important for risk management.

Thanks to this mechanism, you’ll be confident that safeguards are put in place to prevent you from suffering the disadvantages of manipulations in the market and crazy fast movements in the price of your holdings.

Factors Influencing Price Down Limit

Several factors can influence the creation of Price Down Limit for a particular cryptocurrency. Let’s explore a few of them:

Volatility

One of them is market volatility. The cryptocurrency market is infamous for its high volatility, where prices move fast because of fundamental factors like news, events, and, most importantly, sentiment. In a situation where the volatility of the market is higher than expected, a more conservative Price Down Limit is necessary to mitigate risk.

Liquidity

Liquidity is another very important factor. The ability of a cryptocurrency to be bought or sold without affecting its price can influence the effectiveness of Price Down Limits. If you’re investing in an asset with lower liquidity, you might want to lean towards a wider limit. This way, you can avoid massive price slippage, especially on higher-risk large trades.

Exchange Policies

We also have to factor in Exchange policies towards Price Down Limits. Every cryptocurrency exchange may have its specific policies regarding Price Down Limit. These policies might include specific trade criteria, which may range around the size of the trade.

Some exchanges also factor in the duration of the trade. Since these things can be different across most exchanges, you need to get familiar with the Price Down Limit policy of your preferred platform.

Regulatory Requirements

Lastly, regulatory requirements can affect the parameters of a price down limit. Depending on the region, some regulatory authorities in certain jurisdictions can impose specific requirements or guidelines for Price Down Limit.

Sometimes they’re flexible, and sometimes they’re strict. Exchanges that operate in these areas must comply with regulations to maintain legitimate exchange practices. This is why you must consider the exchange of your choice before venturing into it.

Benefits and Limitations

Using Price Down Limit has a lot of benefits to you as a cryptocurrency investor. One very important advantage is risk management, as Price Down Limit helps mitigate the risk of you incurring massive losses when caught on the wrong side of the market.

Price Down Limit also contributes to the overall stability of the market experience by preventing panic trading and the effects of excessive volatility. The knowledge that trading platforms have safeguards like Price Down Limits baked into them improves confidence when signing up on a cryptocurrency exchange. It also increases participation in the industry, ensuring long-term growth.

Unfortunately, Price Down Limit also has its limitations. Sometimes, market participants can try to manipulate prices and trigger Price Down Limits to exploit it for their benefit, especially spoof traders and wash traders. Some traders have also missed trading opportunities in the market.

This mostly happens when the limit is much wider than it should be, considering the volatility of the markets. During high volatility or times when the markets are illiquid, Price Down Limit can be ineffective. If it’s not monitored properly, orders can be executed late, leading to losses, especially when the move is sudden.

Summary

As we’ve seen, Price Down Limit is vital when venturing into cryptocurrency trading. The fact that its long list of benefits helps provide you with a full experience makes it a must to understand the intricacies of Price Down Limit.

By familiarizing yourself with Price Down Limit and other risk management tools, navigating market dynamics confidently becomes easier. Looking ahead, as the Price Down Limit develops in coming years, risk management could become a more efficient mechanism leading to longevity in the markets.